Vietnam's Provincial Merger to Drive Growth: Opportunities for Businesses

Vietnam is undergoing one of its most ambitious administrative restructuring initiatives in decades. As Vietnam navigates its provincial merger, businesses stand to benefit from a more integrated and efficient administrative framework that promises to streamline interactions with government authorities and accelerate decision-making processes.

The process began in early 2025 when the Politburo and Secretariat of the Communist Party of Vietnam issued Conclusion 126-KL/TW, establishing policy directions for abolishing district-level governance, merging provinces, and restructuring commune-level administrative units.

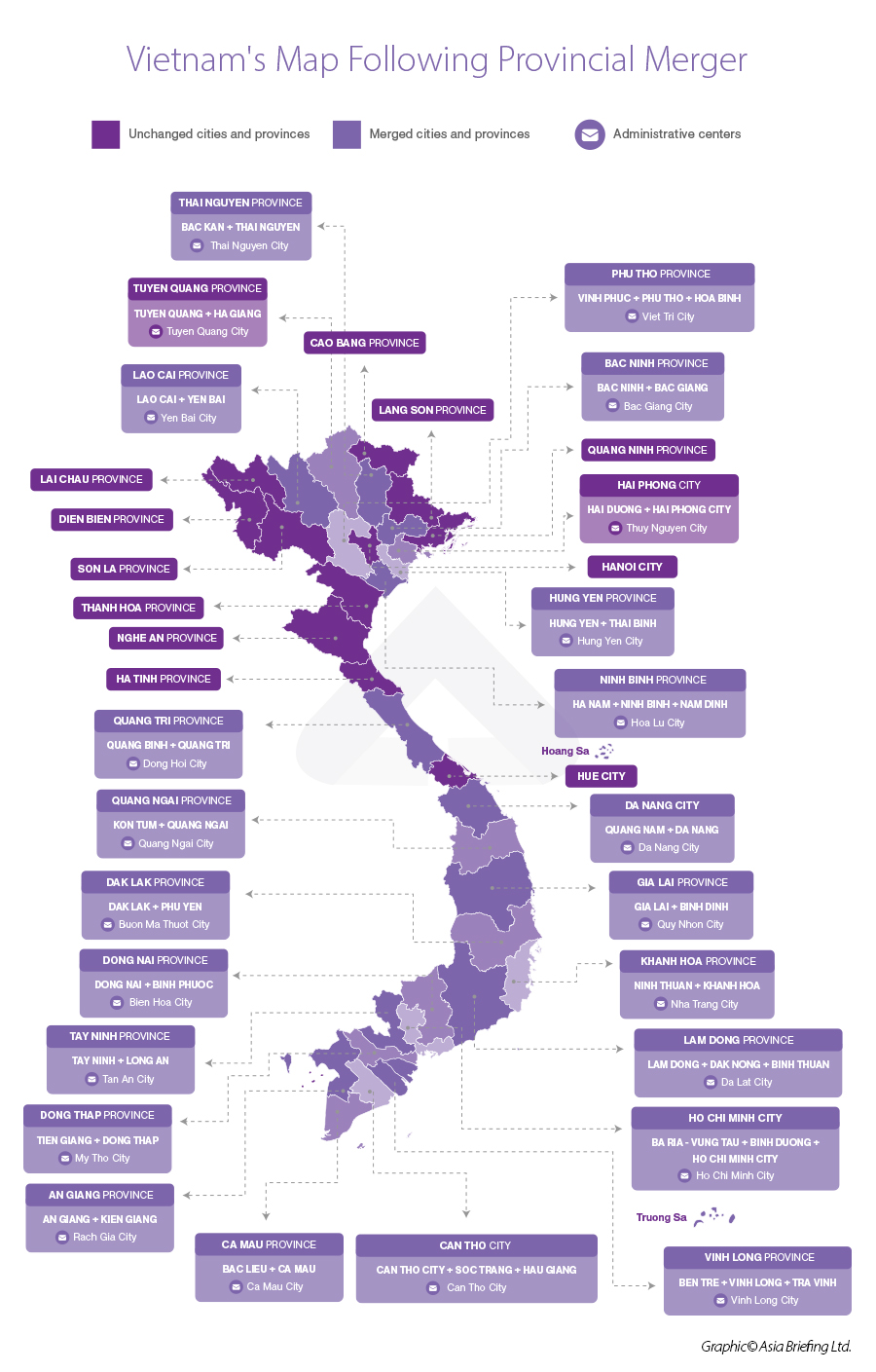

This framework culminated on April 12 with the Central Committee's Resolution No. 60-NQ/TW, which officially mandates reducing Vietnam's 63 provinces to just 34 through systematic consolidation.

The effort represents the most significant restructuring of Vietnam's local administrative units since reunification, reflecting Vietnam's efforts to streamline governance and boost administrative efficiency. While the merger promises substantial benefits, it also presents unprecedented challenges to economic adaptability and institutional coordination.

Also read: Vietnam Officially Consolidates from 63 to 34 Provinces and Cities

Rationale behind the merger

Since the 1975 reunification, Vietnam has undergone several rounds of provincial restructuring. These changes in provincial-level administrative units have primarily aimed to optimize and leverage the unique strengths of each locality, aligning with the evolving needs of national reform and development over time.

According to Nguyen Si Dung, Vice-Chair of the Parliamentary Office, provincial mergers foster regional synergy that aligns with national economic development goals, while local administrative splits historically ensured efficiency suited to each era. Today, advancements in both physical and digital infrastructure, alongside a more competent workforce, have significantly narrowed the gap between central and local governance. As such, the 2025 merger is not only reasonable but also a strategic move.

Streamlining the bureaucracy and strengthening governance efficiency.

The government has set ambitious targets that suggest urgency behind the reforms. Officials want to cut administrative processing times, compliance costs, and business requirements by at least 30 percent by the end of 2025, with deeper cuts planned afterward. Provincial consolidation sits at the heart of this efficiency drive as fewer provinces should mean fewer procedure overlaps, better resource allocation, and streamlined decision-making.

Strengthening provincial synergies

The ongoing provincial mergers will enable localities to amplify their unique strengths while leveraging the complementary advantages of their newly integrated counterparts. This restructuring paves the way for larger, more capable administrative units with unprecedented scale. Notably, the merger will result in Vietnam’s first official metropolis, Ho Chi Minh City (HCMC), comprising the current HCMC, Ba Ria–Vung Tau, and Binh Duong. According to the HCMC Institute for Development Studies, this newly expanded megacity is projected to achieve an economic scale exceeding US$2.7 billion, contributing nearly one-fourth of Vietnam’s GDP. Its total budget revenue is estimated to reach VND 682 trillion (US$26 billion), accounting for close to one-third of the national figure.

Read more: Ho Chi Minh City’s Master Plan: Six Urban Zones, One Mega-City Vision

Cutting down on recurring expenditures in state revenue

According to the Ministry of Finance, Vietnam’s state budget revenue in 2022 reached VND 1.82 quadrillion (US$72.8 billion), while its total expenditures were VND 1.75 quadrillion (US$70.0 billion). More than half of the spending, VND 1.03 quadrillion (US$41.2 billion), was allocated to recurring expenses, including operational costs for the government and socio-political organizations.

In 2023, recurring expenses accounted for more than 61 percent of total spending, staying within a consistent range of 60-65 percent over the past decade, which highlights the need to reform government operations to enhance budget efficiency.

The provincial merger is set to address this issue by streamlining the country’s administrative apparatus. For example, between 2026 and 2030, reducing about 120,500 part-time personnel at the commune level nationwide is projected to save the government around VND 190.5 trillion (US$7.62 billion), averaging VND 38.1 trillion (US$1.52 billion) annually, excluding other related costs.

Opportunities for investors

The consolidation of Vietnam's provincial administrative structure presents significant advantages for foreign investors seeking to enter or expand their presence in the Vietnamese market.

Enhanced administrative efficiency

The merger of provinces signals a shift toward a more integrated and streamlined administrative framework that fundamentally transforms how businesses interact with the government. This consolidation eliminates redundant bureaucratic layers, creating a unified system where investors can work with one consolidated provincial authority instead of managing relationships with multiple smaller administrations.

The practical impact is substantial: decision-making processes accelerate as fewer administrative tiers are involved, approval times for investment projects shrink, and administrative standards become consistent across merged territories.

Vietnam's commitment to this efficiency is evident in its ongoing administrative reform. As of August 1, 2025, ministries and state agencies have eliminated 115 administrative procedures and 118 business conditions while simplifying an additional 691 procedures. This reform process will continue through 2026, ensuring progressive improvements in regulatory efficiency. For businesses, this means simplified land, tax, and labor administration procedures that reduce compliance burdens and create more predictable operating environments.

Larger, more integrated markets

The provincial merger can create substantial economies of scale that fundamentally change Vietnam’s investment landscape. The consolidation results in larger, more integrated markets within single administrative frameworks, offering investors access to expanded consumer bases and more diverse economic activities. This scale transformation is particularly valuable for businesses requiring substantial labor forces, as merged provinces provide wider labor pools with greater flexibility in workforce planning and recruitment across previously separate administrative boundaries. Take the newly formed Lam Dong province as an example. This merged locality combines three distinct economic zones:

- Lam Dong: A hub for high-tech agriculture;

- Dak Nong: Rich in mineral resources and industrial land reserves; and

- Binh Thuan: A coastal province with strengths in renewable energy and logistics infrastructure.

Together, these territories create a strategic corridor connecting the Central Highlands, midlands, and coastal areas, enabling the development of inter-sectoral value chains, urban-industrial clusters, and sustainable tourism zones. The new Lam Dong will become Vietnam’s largest province by land area. spanning 24,233 km² with a population exceeding 3.3 million, offering a more integrated, efficient, and future-ready development platform for foreign investors.

Improved infrastructure planning

Administrative consolidation provides the scale and authority needed for ambitious infrastructure projects. Vietnam's fragmented approach to infrastructure planning has traditionally hindered major initiatives, with the road connecting Nam Dinh City to Tan De Bridge serving as a clear example. Thai Binh finished its part years ago, while Nam Dinh's section remained delayed due to perceived limited local benefits. The provincial merger aims to end such delays by strategically unifying spatial planning authorities with complementary resources and development priorities, thus enabling coordinated investments that improve transport links and boost economic growth.

Recent project announcements signal this strategic shift. HCMC will begin construction of a 30-kilometer metro line extending into the former Binh Duong province in 2027, with service starting in 2031. A VND 5 trillion road project (US$190 million) will connect Thai Binh ward in the former Thai Binh City to Hung Yen Province's new administrative center, scheduled for completion in 2028.

For foreign companies, better infrastructure translates into real bottom-line benefits. Shipping goods between provinces becomes cheaper and more predictable. Market entry happens faster when roads, ports, and rail links actually connect where they are supposed to. Companies can also build more resilient supply chains when they are not constantly worrying about whether critical transport links will hold up during peak season or adverse weather conditions.

Considerations for businesses: Challenges ahead

In addition to the promising benefits, the administrative revisions following the consolidation are a test for the strategy management and regulatory compliance of businesses and investors. These temporary challenges require careful consideration to reduce negative impacts and to encourage the quick achievement of positive outcomes.

Administrative and policy transition

Provincial mergers bring administrative complications. Different regulatory frameworks, land-use plans, and investment policies do not merge overnight. The 2008 consolidation of Ha Tay with Hanoi offers a cautionary example: bureaucratic confusion and conflicting regulations created approval bottlenecks that persisted for years. Investors often found themselves navigating contradictory requirements while officials sorted through overlapping jurisdictions.

The same challenges await current merger plans. Until authorities finalize new provincial master plans, businesses are likely to encounter mixed signals on licensing requirements and land allocation procedures. What works in one former province may not apply in another, leaving investors to guess which rules govern their projects.

Infrastructure and labor disparities

Despite the goal of improving connectivity, infrastructure quality and logistics capacity still vary across newly merged areas currently. For example, in the new Lam Dong province, transport links between the Central Highlands and coastal Binh Thuan remain incomplete. At the same time, wage and skill differences between regions can complicate workforce planning.

Changes to investment incentives and local relationships

Pre-merger competition for foreign direct investment (FDI) often meant generous tax breaks and preferential land leases. After the consolidation, some of these benefits may be reduced or withdrawn. Leadership reshuffles in provincial departments and industrial zone boards can also disrupt established investor–government relationships, requiring renewed engagement and networking to maintain project momentum.

Also read: 2025 CIT Law: Implications to Manufacturing Companies in Industrial Parks

What to do?

Monitor policy updates closely

Provincial master plans, land-use policies, and investment incentives will evolve as merged administrations find their footing. Rather than relying on outdated information, firms must establish direct channels with both provincial authorities and industry associations. These relationships prove invaluable when regulations change without warning or when competing interpretations emerge from different departments.

Reassess site selection and supply chains

Larger administrative units create new possibilities that smaller provinces are incapable of providing.

Companies should map how improved connectivity might reshape their operations, whether that means consolidating warehouses, diversifying supplier networks, or accessing previously fragmented markets. The businesses that capitalize on these expanded networks early often secure lasting competitive advantages.

Strengthen local engagement

Administrative reshuffles inevitably bring new faces to key positions. The officials who approved your last project may no longer hold decision-making authority. Local business forums, FDI dialogues, and industry roundtables become more critical during these transitions. Building trust with emerging leaders while maintaining ties with established networks helps ensure projects don't stall when personnel change.

If you want to understand how your organization in Vietnam needs to adapt to stay compliant, get in touch with us for an assessment.

This article first appeared on Vietnam Briefing, our sister platform.