China’s Expanding FTA Network: Unlocking New Opportunities for Global Investors

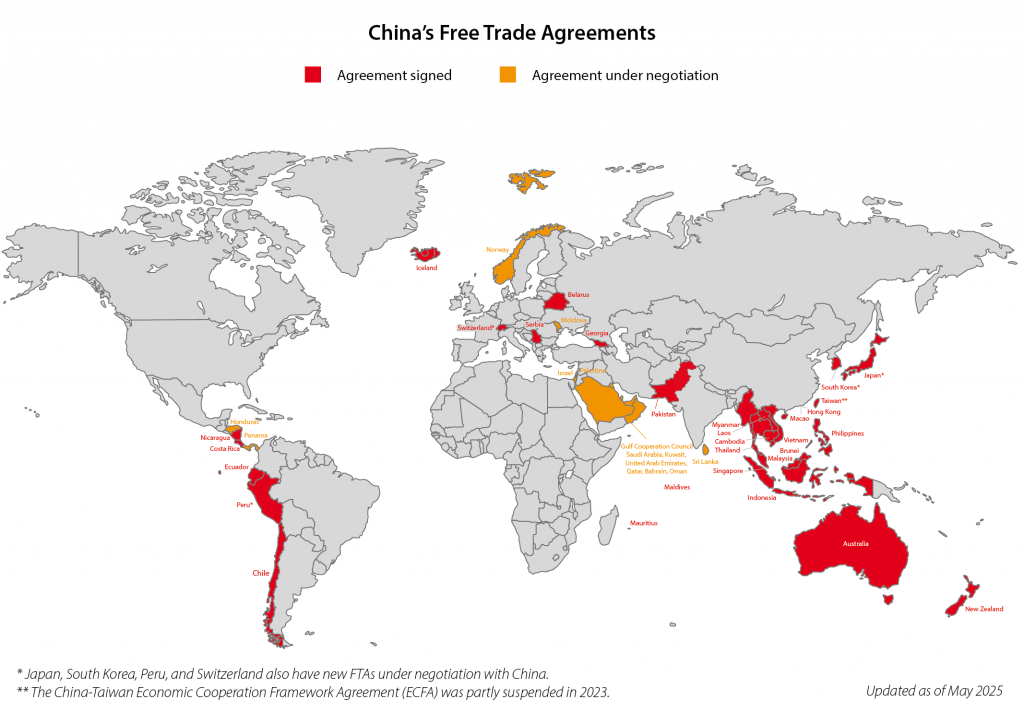

China’s FTA framework is reshaping global trade and unlocking new opportunities for foreign investors. With 23 FTAs signed and a growing focus on digital and green sectors, China offers a strategic gateway to Asia and beyond.

As global trade faces increasing uncertainty, China continues to champion multilateralism and free trade by accelerating its high-level opening-up. Central to this strategy is the development of a comprehensive Free Trade Agreement (FTA) framework that spans five continents and includes some of the world’s most dynamic economies. For foreign investors and businesses, China’s FTA network is more than a diplomatic achievement. It’s a gateway to new markets, streamlined operations, and long-term growth.

China’s FTA landscape is growing rapidly

China’s FTA footprint has grown significantly in recent years. As of 2025, the country has signed 23 FTAs with 30 countries and regions, including major economies in Asia, Latin America, and Europe. These agreements cover a wide range of sectors and increasingly incorporate high-standard provisions on digital trade, green economy, and investment protection.

| Countries/Regions Having FTAs with China | ||

| FTA | Countries | Status |

| China-Belarus Service and Investment Agreement | Belarus | Signed |

| China-Serbia FTA | Serbia | Signed and effective |

| China-Ecuador FTA | Ecuador | Signed and effective |

| China-Nicaragua FTA | Nicaragua | Signed and effective |

| RCEP | ASEAN (10), China, Japan, South Korea, Australia, New Zealand | Signed and effective |

| China-Cambodia FTA | Cambodia | Signed and effective |

| China-Mauritius FTA | Mauritius | Signed and effective |

| China-Maldives FTA | Maldives | Signed and effective |

| China-Georgia FTA | Georgia | Signed and effective |

| China-Australia FTA | Australia | Signed and effective |

| China-Korea FTA | South Korea | Signed and effective |

| China-Switzerland FTA | Switzerland | Signed and effective |

| China-Iceland FTA | Iceland | Signed and effective |

| China-Costa Rica FTA | Costa Rica | Signed and effective |

| China-Peru FTA | Peru | Signed and effective |

| China-Singapore FTA | Singapore | Signed and effective |

| China-New Zealand FTA | New Zealand | Signed and effective |

| China-Chile FTA | Chile | Signed and effective |

| China-Pakistan FTA | Pakistan | Signed and effective |

| China-ASEAN FTA | Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam | Signed and effective |

| Mainland and Hong Kong Closer Economic and Partnership Arrangement | Hong Kong | Signed and effective |

| Mainland and Macao Closer Economic and Partnership Arrangement | Macao | Signed and effective |

| China-Taiwan ECFA | Taiwan | Signed and partly suspended since 2023 |

| FTAs under Negotiations | ||

| FTA | Countries | Status |

| China-Honduras FTA | Honduras | 6 rounds negotiations + early harvest arrangement signed |

| China-GCC FTA | Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman | 11 rounds negotiations |

| China-Japan-Korea FTA | Japan, South Korea | 16 rounds negotiations |

| China-Sri Lanka FTA | Sri Lanka | 6 rounds negotiations |

| China-Israel FTA | Israel | 8 rounds negotiations |

| China-Norway FTA | Norway | 14 rounds negotiations |

| China-Moldova FTA | Moldova | 2 rounds negotiations |

| China-Panama FTA | Panama | 5 rounds negotiations |

| China-Korea FTA second phase | South Korea | 11 rounds negotiations |

| China-Palestine FTA | Palestine | 1 round negotiation |

| China-Peru FTA Upgrade | Peru | 7 rounds + substantive negotiations completed |

| China-Switzerland FTA Upgrade | Switzerland | 1 round negotiation |

|

FTAs under Consideration |

|

| FTA | Countries |

| China-Colombia FTA Joint Feasibility Study | Colombia |

| China-Fiji FTA Joint Feasibility Study | Fiji |

| China-Nepal FTA Joint Feasibility Study | Nepal |

| China-Papua FTA Joint Feasibility Study | Papua |

| China-Canada FTA Joint Feasibility Study | Canada |

| China-Bangladesh FTA Joint Feasibility Study | Bangladesh |

| China-Mongolia FTA Joint Feasibility Study | Mongolia |

How China’s FTA network compares to other emerging markets

| FTA Frameworks: China vs. Vietnam vs. India | |||

| Aspect | China | Vietnam | India |

| FTA coverage | 23 FTAs signed, 10 under negotiation; includes RCEP, bilateral FTAs with Latin America, ASEAN, and Belt & Road partners | 19 FTAs (16 in effect); includes CPTPP, EVFTA, RCEP, ASEAN+1 FTAs; highly diversified partner base | 13 FTAs signed; key FTAs with ASEAN, Japan, South Korea; negotiations underway with EU, UK, USA |

| Strategic orientation | Global outreach with emphasis on regional integration and Belt & Road connectivity | Deep integration into global supply chains; proactive in signing high-standard FTAs | Cautious and selective; prioritizes strategic autonomy and domestic industry protection |

| Standards and depth | Increasing inclusion of digital economy, green economy, and services (e.g., China-Singapore 4.0, China-ASEAN 3.0) | New-generation FTAs include investment protection, services liberalization, and institutional reforms (e.g., CPTPP, EVFTA) | Earlier FTAs were shallow; newer ones (e.g., India-Korea CEPA) include investment and competition policy, but services and procurement remain limited |

| Investor benefits | Broad market access; integration into regional value chains; growing openness in services and investment | Preferential access to 55 markets; strong FDI inflows; improved legal and business environment; CPTPP and EVFTA offer high-standard access | Mixed results; FTAs have led to trade deficits; low utilization by exporters; regulatory unpredictability hampers investor confidence |

| Challenges | Varying regulatory depth across FTAs; limited coverage of labor and environmental standards | SMEs face competition pressure; compliance with high standards needed; institutional capacity still developing | Infrastructure bottlenecks; complex bureaucracy; labor rigidity; opted out of RCEP due to domestic concerns |

| China+1 positioning | Anchor economy in RCEP; key FTA partner for ASEAN and Belt & Road countries | Leading beneficiary of China+1 strategy; strong infrastructure, labor flexibility, and FTA access attract global firms | Lagging behind in China+1; struggles with execution, infrastructure, and policy consistency |

How China’s FTA network benefits foreign investors

China’s FTA framework offers a range of tangible benefits for foreign enterprises seeking to enter or expand in the Chinese market. These advantages span trade facilitation, investment liberalization, and participation in emerging sectors.

Preferential market access reduces costs

One of the most immediate benefits of FTAs is tariff reduction or elimination, which lowers the cost of exporting goods to China. For example, under the China-Chile FTA, Chilean wine and cherries have gained widespread popularity in China, with bilateral trade increasing 7.5 times since the agreement took effect. Similarly, the China-ASEAN FTA has enabled a surge in tropical fruit imports from Southeast Asia. Products like durian, mango, and coconut have become staples in Chinese supermarkets, improving consumer welfare while boosting incomes for ASEAN producers.

Investment facilitation improves legal certainty

Modern FTAs increasingly include investment chapters that provide legal certainty and protection for foreign investors. These provisions typically cover fair treatment, dispute resolution mechanisms, and transparency in regulatory processes. Singapore’s experience is illustrative. As a long-standing FTA partner, it has become China’s largest source of new investment for 11 consecutive years. In 2024 alone, Singapore’s actual investment in China grew by 10.8 percent, supported by the upgraded China-Singapore FTA (Version 4.0), which enhances openness in services and investment sectors.

Regional value chains offer competitive advantages

Emerging sectors are opening up

Recent FTA upgrades reflect China’s commitment to high-standard and future-oriented cooperation. Agreements now include provisions on the digital economy, green development, and cross-border services. For instance, the China-Nicaragua FTA, which came into effect in 2024, introduced a negative list approach for services trade, marking a first in China’s FTA history. This provides greater clarity and openness for foreign service providers, especially in sectors like fintech, education, and healthcare.

The business environment is becoming more predictable

FTAs also contribute to a more predictable and transparent regulatory environment. By reducing non-tariff barriers and aligning standards, they help foreign businesses navigate local compliance requirements more efficiently. Moreover, FTAs often include mechanisms for dispute resolution and regulatory cooperation, which are crucial for businesses operating across borders. These features enhance investor confidence and reduce operational risks.

Case studies show real-world impact

Several bilateral FTAs have delivered tangible results, showcasing how trade agreements can reshape economic relationships and unlock mutual benefits:

- China–Chile: Bilateral trade reached RMB 4,387 billion (US$600 billion) in 2024. Chilean exports such as wine and cherries have gained strong traction in China, successfully capturing niche consumer markets and elevating Chile’s agricultural brand presence.

- China–Costa Rica: Trade volume rose to RMB 552 billion (US$75 billion), marking a 37.7 percent year-on-year increase. The FTA has significantly boosted bilateral commerce, particularly in electronics, medical devices, and agricultural products.

- China–Nicaragua: In the first year of the FTA’s implementation, bilateral trade surged by 48.2 percent. Imports from Nicaragua—including sugar, shrimp, and cotton yarn—grew by more than 220 percent, reflecting the agreement’s immediate impact on market access and trade diversification.

These examples illustrate how FTAs can go beyond tariff reductions to foster deeper economic ties, enhance product competitiveness, and create win-win outcomes for both sides.

China is pursuing new frontiers in FTA development

China is actively pursuing new FTAs and upgrades to existing ones. Negotiations are underway with countries like Honduras, El Salvador, and South Korea, while talks with Switzerland and New Zealand focus on expanding services trade and adopting negative list approaches. China is also seeking accession to CPTPP and DEPA, signaling its readiness to align with high-standard international trade rules. These efforts are expected to drive domestic reforms and open new sectors to foreign participation. The upgraded China-ASEAN FTA (Version 3.0) and the China-Peru FTA now include rules on digital trade, green economy, and supply chain resilience, offering new growth points for foreign businesses in emerging industries.

Conclusion: FTAs are a strategic gateway to China

China’s FTA framework is evolving into a strategic platform for global cooperation, offering foreign investors and businesses a wealth of opportunities. From preferential market access and investment facilitation to participation in digital and green sectors, the benefits are multifaceted and growing. As China continues to expand and upgrade its FTA network, foreign enterprises should stay informed and proactive. Engaging with China through its FTAs not only enhances competitiveness but also positions businesses to thrive in a more integrated and dynamic global economy.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China’s Demographic Trends by Province and City: An Investor’s Analysis

- Next Article China Port Visa Explained: Who Needs it and How it Compares to Visa-Free Entry