China Tech Cities on the Rise: AI and VC Opportunities for Global Investors

China tech cities like Beijing, Shanghai, and Shenzhen are emerging as global innovation hubs in AI and advanced technologies. These cities offer foreign investors targeted opportunities in sectors such as biotech, smart manufacturing, and semiconductors. This article explores how policy, talent, and capital are reshaping China’s urban tech ecosystems.

Global demand for tech talent and investment continues to accelerate as artificial intelligence reshapes industries and business strategies. Cities that can offer the right mix of talent, infrastructure, and innovation ecosystems are becoming key destinations for both capital and corporate expansion.

Recent global tech rankings place several Chinese cities—including Beijing, Shanghai, and Shenzhen—among the most competitive hubs in the Asia-Pacific (APAC) region, with notable strengths in AI and advanced technologies. These cities attract attention not only for their sector strengths, but also for their scale and strategic focus on advanced technologies like AI and semiconductors.

At the same time, foreign capital is retreating from China’s venture scene, and investment is increasingly concentrated in state-backed sectors such as manufacturing and AI. Understanding the forces behind this shift and the opportunities that remain is critical for companies planning to engage with China’s evolving tech landscape.

How Chinese cities performed in the global rankings

Chinese cities continue to lead the APAC technology landscape. Beijing, in particular, ranks among the top five global tech talent markets, standing out as the highest-ranked city in the region. Its strong sector composition, high-value tech presence, and dense R&D ecosystem—particularly in AI and big data—position it as a regional innovation leader.

Other major cities, including Shanghai, Shenzhen, Hangzhou, and Guangzhou, also perform strongly across several indicators. Together, these hubs account for six of the top 10 cities in APAC by venture capital investment and deal volume, reflecting China’s continued dominance in the region’s tech funding landscape.

Each city offers distinct sector strengths:

- Shanghai serves as a financial technology and smart mobility hub, supported by a robust professional services ecosystem and advanced infrastructure.

- Shenzhen leads in hardware, telecommunications, and consumer electronics, underpinned by its role as a manufacturing and export base.

- Hangzhou is home to China’s digital economy pioneers, including Alibaba and Ant Group, making it a key center for fintech and e-commerce innovation.

- Guangzhou focuses on advanced manufacturing and automotive technology, with growing emphasis on biotech and green energy.

While labor market density in Chinese cities trails that of major U.S. and Indian hubs, their scale advantages—combined with policy support and maturing startup ecosystems—continue to draw domestic and regional tech investments.

Factors behind China’s tech ascent

A mix of structural and policy factors drives the strong performance of Chinese tech cities in regional and global rankings.

National industrial policy support

China’s tech growth is underpinned by long-term national strategies, including the Artificial Intelligence Development Plan, Made in China 2025, and the Digital China initiative. These policies prioritize core technologies such as AI, semiconductors, and next-generation communications, and provide clear roadmaps for both public and private sector engagement.

Government-backed venture capital and city-level incentives

Chinese cities benefit from extensive government guidance funds and venture capital programs. Local governments often offer subsidies, tax incentives, and free office space to tech startups, especially in strategic sectors like AI and deep tech. This coordinated funding ecosystem reduces early-stage financial risks and accelerates commercialization.

Expanding startup ecosystems in tier 1 and emerging tier 2 cities

While Tier 1 cities such as Beijing and Shanghai remain dominant, emerging hubs like Chengdu, Xi’an, and Nanjing are cultivating competitive startup communities. These cities offer lower operating costs, access to regional talent pools, and dedicated innovation zones, attracting companies focused on niche technologies and regional markets.

Infrastructure and talent pipelines

China’s digital infrastructure, ranging from 5G networks to cloud platforms, is among the most advanced globally. At the same time, a strong university system continues to feed the talent pipeline. Institutions like Tsinghua, Peking University, and Zhejiang University are closely linked to the tech sector, fostering collaboration in R&D and commercialization.

Market access and supply chain integration

Chinese tech cities are deeply integrated with regional and global supply chains. Their proximity to major consumer markets, advanced logistics infrastructure, and manufacturing clusters helps tech firms scale from R&D to production. This integration is especially relevant for firms in hardware, semiconductors, and industrial AI.

Together, these factors create a supportive environment for innovation, investment, and long-term growth in China’s technology sector.

Strategic implications for foreign investors

China’s evolving tech landscape presents both opportunities and challenges for foreign investors seeking innovation-driven growth. One of the key constraints is the intensifying competition for AI-related talent. As demand for skilled professionals in data science, machine learning, and cybersecurity continues to rise, foreign firms may face higher recruitment costs and increased difficulty in attracting top talent. Building R&D partnerships with universities or working through local incubators can help navigate these barriers.

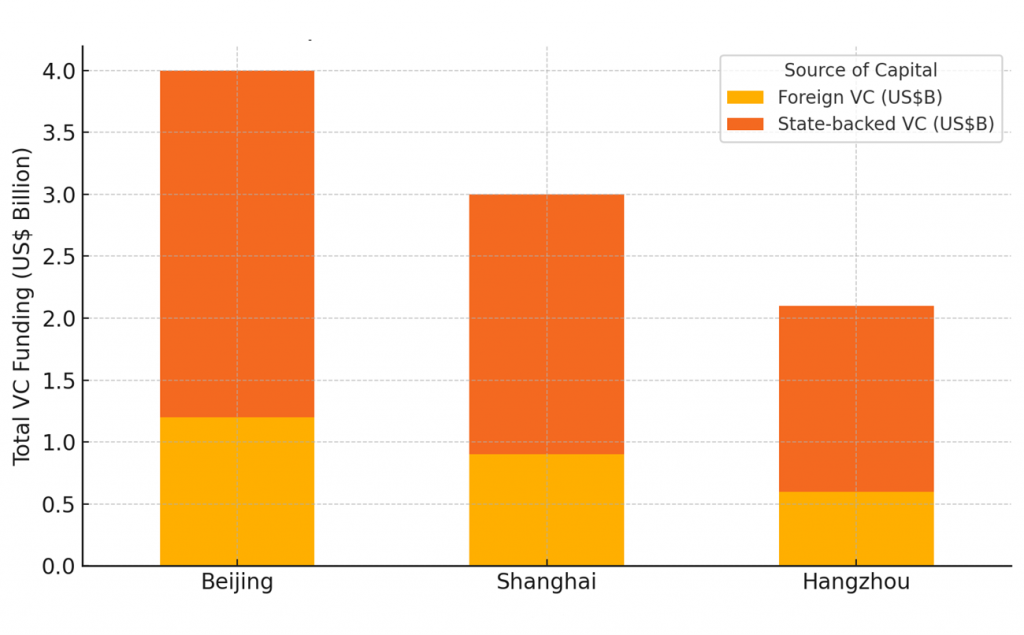

At the same time, the sustained venture capital activity in Chinese tech hubs points to long-term growth potential. While the volume of foreign capital has declined, local investment remains active, especially in areas prioritized by industrial policy, such as semiconductors and AI. Foreign investors may explore joint ventures, minority investments, or co-investment arrangements. With state-backed capital now dominating VC flows in major hubs like Beijing, Shanghai, and Hangzhou, these models offer a practical path forward.

VC Funding in Leading Chinese Tech Cities (Q1 2025)

Source: National Venture Capital Association Pitchbook Q1 2025

Source: National Venture Capital Association Pitchbook Q1 2025

Beyond capital investment, foreign firms can benefit from aligning with local innovation agendas. Partnering with established Chinese funds or accelerators not only facilitates entry but also helps navigate regulatory complexity and shifting market dynamics.

How to leverage these trends

To effectively engage with China’s tech ecosystem, foreign investors should adopt a localized and sector-specific approach. One practical strategy is to form partnerships with local venture funds, accelerators, or incubators that offer access to early-stage startups and sector-specific networks. These partnerships not only help mitigate entry risks but also create alignment with local innovation agendas.

Targeting cities based on their specialization, for example, Hangzhou for fintech or Shenzhen for hardware, helps align strategy and ease market entry. Matching strategies to each city’s strengths can improve investment outcomes.

In addition, soft-landing programs in innovation zones and free trade zones can provide useful entry points for foreign firms. These zones often offer streamlined business setup procedures, preferential tax policies, and tailored support services that simplify entry into China’s regulatory environment.

Finally, it is essential to stay updated on China’s evolving compliance frameworks, particularly in areas such as cross-border data transfers, cybersecurity, and intellectual property protection. Proactive monitoring of policy changes and working with experienced legal and advisory teams can help investors remain compliant while capturing long-term value in China’s fast-changing tech sectors.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Breaking Down the US-China Trade Tariffs: What’s in Effect Now?

- Next Article